The country has seen a soar in investment this year (Photo: soha.vn)

The country has seen a soar in investment this year compared to 0.4 percent last year, according to the Fintech in ASEAN report released by the United Overseas Bank (UOB).

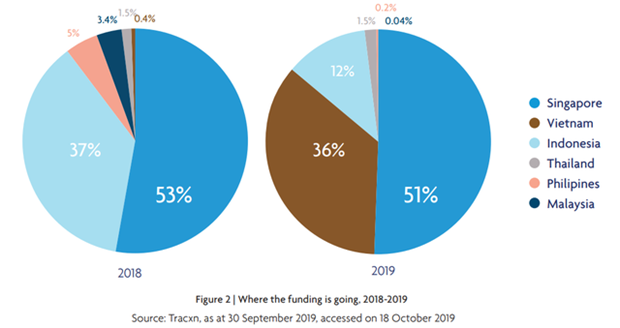

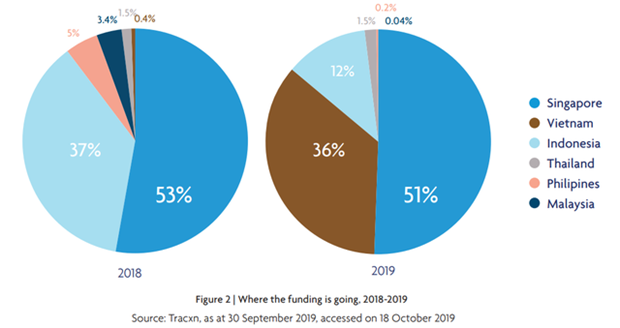

Singapore took the leading position with 51 percent, down from 53 percent last year.

Indonesia stepped down one place to third with 12 percent, compared to 37 percent last year.

Thailand, Malaysia and the Philippines accounted for less than 2 percent of Southeast Asia's total fintech investment, down sharply from about 10 percent last year.

In Vietnam, the leading field attracting venture capital in fintech companies was payment.

VNPay, a Vietnamese e-payment solutions provider, took the lead in the report with total capital revealed to be 300 million USD this year.

Singaporean insurance company Singapore Life ranked second with deals worth 110.3 million USD, while Vietnamese MOMO Pay e-wallet ranked third with 100 million USD.

After attracting just 35 million USD in 2014, the total amount of venture capital invested in the fintech sector in Southeast Asia has increased sharply over the past five years to 679 million USD last year.

The total figure has reached 1.14 billion USD from the beginning of 2019.

With an annual growth rate of up to double digits, digital payment is expected to become the payment method of choice from nearly 50 percent of transactions from now to 2025, and will exceed 1 trillion USD.

Fintech companies are targeting about 300 million adults in Southeast Asia who do not have bank accounts or access to associated investment, credit and insurance services.

The number of financial transactions made on mobile phones in Vietnam had nearly doubled as of March 31 this year compared to last year, according to the State Bank of Vietnam.

The Vietnamese mobile payment market is expected to reach 70.9 billion USD by 2025, up from 16 billion USD in 2016./.

VNA

Central bank mulls raising gold position limit for lenders

Central bank mulls raising gold position limit for lenders